Table of Content

Because it can indicate to sellers and realtors that you are a serious prospective buyer, it may give you an edge when it comes to making offers on homes you’re interested in. Further, if you do not qualify for GUS, the USDA will have to manually underwrite the loan application, which could in turn require additional time to gather needed verification. After you find the perfect home, you will work with your lender and agent to make an offer. This is the time to negotiate with the seller about covering some or all of your closing costs.

Yes, the USDA loan program can be used to make eligible repairs and improvements to a home. Yes, the USDA loan program can be used for newly-built homes and other new construction. The only exception is for very-low-income borrowers, who may qualify for a USDA Direct home loan. In this case, you’d go straight to the Department of Agriculture to apply rather than to a private lender. Yes, they may be assumed by a new homeowner if they and the property are eligible for USDA financing. This may allow the borrower to avoid the upfront guarantee fee and land a lower interest rate.

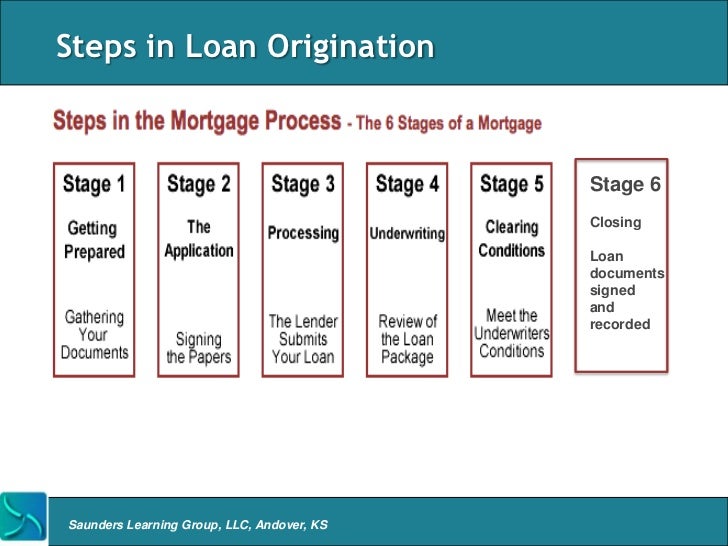

USDA loan underwriting process

For example, if the home you’re buying is appraised at $245,000 but you’ve agreed to pay $250,000, you’ll need to make a $5,000 down payment. Yes, USDA mortgages require borrowers to escrow taxes and homeowners insurance with the lender. This means you’ll pay your taxes and insurance along with your mortgage each month. You may not pay your real estate taxes or annual homeowner insurance separately. Because closing costs vary, be sure to shop around to find the most suitable combination of low mortgage rates and low costs.

A guaranteed loan helps the same category of applicants but comes with 100 percent financing at a 30-year fixed-rate term. With USDA-guaranteed loans, mortgage insurance premiums are just a fraction of what you’d typically pay. A USDA home loan is a zero-down payment mortgage loan for eligible rural and suburban homebuyers. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, by the United States Department of Agriculture. USDA home loans offer 100% financing to qualified buyers, and allow for all closing costs to be either paid for by the seller or financed into the loan.

How Hard Is It To Get Approved For A Usda Loan?

Department of Agriculture and are intended to assist low- to moderate-income homeowners in purchasing a home. USDA loans, in addition to their benefits, include the possibility of 100% financing. Furthermore, there are a number of disadvantages to be aware of. The loan will be subject to a 1% upfront fee and a 3% annual fee.

As its name suggests, USDA Direct Loans are underwritten directly by the USDA, rather than a mortgage lender. If there are any issues with either the appraised value or the property not meeting USDA standards, they must be remedied before closing. USDA guidelines require that all properties be located in a qualifying rural area. To the applicant, getting a USDA loan will “feel” just like getting any other mortgage. When people own homes, they purchase home-related goods and services and tend to stay in the neighborhood longer. USDA home loans are backed by the US Department of Agriculture to promote economic development in rural areas of the U.S.

USDA home loan income eligibility

You can use this easy property eligibility map to do a quick look-up by property address. That’s why we are here, to guide you through the process of obtaining a home loan every step of the way. The home has been appraised, you’re officially under contract.

Lenders are able to extend this seemingly risky financing option to borrowers thanks to a 90 percent loan guarantee provided by the USDA. Often, lenders will send an independent third party to verify the value of a property. This appraisal helps to determine if the home and property value is worth the loan amount. Once you’ve found a home meeting the qualifications, you’ll have to make an offer.

Types of Home Loan Programs

The faster all parties work together to complete and provide documents for loan approval, the quicker final loan approval and closing can happen. In order to be pre-approved for a Rural Development Loan, you’ll need to finish your application by providing documents that support the information on your loan application. There are many online lenders that don’t require you to upload documents before you give you a pre-qualification. You don’t have to search very hard to see story after story of hopeful homebuyers who had their loans denied after doing one of these online approvals.

In order to be eligible for many USDA loans, household income must meet certain guidelines. Also, the home to be purchased must be located in an eligible rural area as defined by USDA. If the seller accepts your offer, then you’ll sign a purchase agreement, and your lender will order a home appraisal. The appraisal is different from a home inspection, and it’s a requirement for USDA loan approval. As the name itself implies, the USDA rural development loan promotes homeownership in eligible rural areas for both first-time home buyers and established borrowers alike. Your loan officer will most likely want to know your desired loan amount, monthly income, and monthly debts.

First, make sure you have a good credit score and a steady income. Then, find a lender who is familiar with the USDA loan program and apply with them. You may also want to get a cosigner on your loan to increase your chances of approval.

Those who are eligible can use a USDA mortgage to buy a home or refinance one they already own. From any lender that is approved to make such loans, which includes hundreds of banks nationwide, from small local mortgage bankers to credit unions to major national lenders. You need a 640 credit score to get an automated approval for a USDA loan, but some lenders will go into the 500s with expensive pricing adjustments. If you have bad credit, you may want to take a hard look at your credit history and clean it up as much as possible before applying. You can’t make more than 115% of the median family household income for the area in which you wish you purchase the home. One of the biggest eligibility requirements is that the property be located in a designated rural area.

Only recently has it been updated and adjusted to appeal to rural and suburban buyers nationwide. The Rural Development loan is sometimes called a “Section 502” loan. This refers to section 502 of the Housing Act of 1949, which makes the program possible. This program is designed to help single-family home buyers and stimulate growth in less-populated, “rural,” and low-income areas. To be eligible, you can’t make more than 115% of the area median income. The monthly premium must be paid for as long as you keep the loan.

In other words, they’re low and competitive, but still take the time to shop around and get multiple rate quotes. Yes, but you’ll need to provide two years of tax returns to ensure it is stable and in the same line of work. They are sold as-is and may be subject to outstanding real estate taxes and assessments. While there typically isn’t a large inventory of homes for sale, you can search on their website in your desired state and county for available listings. The average savings via refi is $150 per month, and the USDA says some borrowers have saved as much as $600 a month, or $7,200 annually. You can use a loan calculator to determine the potential savings beforehand.

To get one, you’d go to an approved lender, and the government in turn guarantees it for the bank from which you borrowed. Yes, USDA loans allow gifts from family members and non-family members. Let your loan officer know as soon as possible that you’ll be using gifted funds, as this requires extra documentation and verification on the lender’s part. With the USDA Rural Housing Program, your home must be located in a rural area.

Getting a USDA loan is similar to getting any other loan, but there are more strict requirements you must meet in order to qualify. If you want to know how to apply for a USDA Rural Development Loan, check out the seven steps below. The USDA Rural Development loan allows more Americans to have the opportunity to purchase a home by providing a loan program that doesn’t require a down payment. You should check your credit rating before making any final decisions. To acquire an Aadhaar card loan, a consumer has to have a credit score of 750 or above. Most notably, the interest rate charged by financial institutions is rather low under these circumstances.

No comments:

Post a Comment